Register

Gas Prices Aren't The Only Reason We Might See More Cimarex/Cabot Style Mergers

Insight

•

Updated September 16, 2021

When the industry (and investors) talk about upstream portfolio optimization in an ESG context it is often focused on the divestment of the most carbon intensive assets. However, the massive carbon intensity differential (~10x) between gas and oil production may lead some operators to look to add more gas exposure to their portfolio.****

David Wishnow

Darcy Partners

Oil & Gas

Sustainability

When Cabot and Cimarex announced a merger of equals in May, it was in stark contrast to the majority of transactions in the industry which were largely focused on consolidating operations within a single basin. This saw independents shed non-core assets and increase exposure in single basins, via either corporate level transactions as with Pioneer/Parsley or via bolt-on A&D and acreage trades. The rationale for these consolidation transactions was driven by enhanced capital efficiency associated with streamlined midstream operations, logistics, etc. On the other side of the equation we've seen large multi-nationals look to decrease exposure to high carbon intensity assets like heavy oil. What we have not seen historically was a merger between an oil levered operators like Cimarex (primarily the Permian and Mid-Con) and gas levered operators in the Northeast (Cabot operated in the Marcellus & Utica). At the time of the Cimarex Cabot announcement, there was significant head scratching across the investment community as many didn't see the value in diversify operations and commodity exposure (the subsequent rise in gas prices to >$5.25/mcf not-withstanding).

Our recent work on the E&P Sustainability Fact Sheet has raised an interesting value proposition that we (and many other observers) may have missed. Once we were able to standardize the reported carbon intensities of various E&Ps, it became abundantly clear how much less carbon intensive dry gas operations are relative to oil. The average gas weighted producer (EQT, Southwestern, Antero, Range) has a carbon intensity of 2.6 mTCO2e/mBoe compared with oil weighted producers in the 20-30 mTCO2e/mBoe range. The implication of this disparity means that by combining the operations of a dry gas operators like Cabot with a liquids focused operator like Cimarex the production profile can be effectively doubled (on a boe basis) which improves the corporate level metrics and returns while simultaneously cutting carbon intensity by almost 50%.

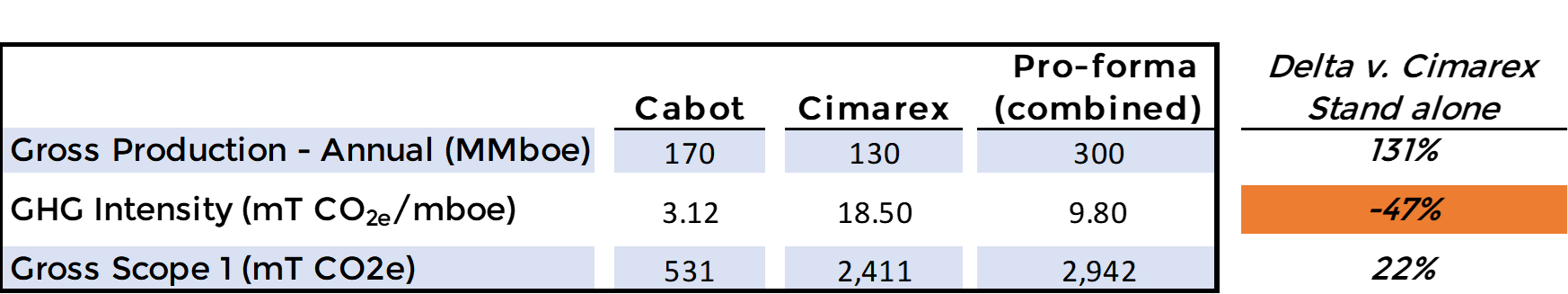

In the following analysis we took the reported 2019 gross production and Scope 1 emissions and GHG intensity metrics from Cabot and Cimarex. We further held the production flat with 2019 levels and assumed no Scope 1 synergies for emissions. The result was a combined entity producing 300 MMboe/yr and 2,942 mTCO2e of Scope 1 emissions - both materially higher than either of the entities, but the production uplift was far steeper than the increase in GHG emissions.

The result being a combined carbon intensity of 9.80 mT CO2e/mboe for the combined organization. This means that by merging a liquids heavy operator with a dry gas operator the combined carbon intensity is inline with Equinor and materially ahead of most of the other diversified large independents who are typically in the mid-teens or above. See E&P Sustainability Fact Sheet for additional detail on carbon intensity.

This analysis is based on the reported 2019 results of each company and as a result we do not give any additional credit for further sustainability or energy transition initiatives - which both organizations have committed to. Further, as a larger entity with a more diverse asset base it is likely the combined company would be able to take advantage of a broader spectrum of low-carbon initiatives than either of the stand alone entities.

Leave a comment below and let us know if you think we'll see a wave of "de-consolidation' across basins as the industry seeks to improve their emissions profile.

Note: this analysis was based on publicly available information and should not be considered as a basis for investment decisions

Related Content

Overview of Major Canadian Pipelines and Refineries

Oil & Gas

Executive

Production

Ambyint Tourmaline SPE Presentation March 2025

Oil & Gas

Production

Subsurface

Event Recording - Super Emitter Events: Challenges and Best Practices

Sustainability

Methane Emissions

Darcy Insights - Beyond the Logs: Leveraging Drilling Data for High-Resolution Geomechanical Characterization

Oil & Gas

Subsurface