Register

Hydrogen: Economics - Part 2

Insight

•

Updated March 31, 2021

In the past weeks we've been talking about the importance of hydrogen; we've mentioned some ongoing projects around the world, federal incentives, some of the colors of hydrogen and mentioned their efficiency and environmental impacts. This week we want to shine a light upon their costs.

Mora Fernández Jurado

Darcy Partners

Energy Transition

Hydrogen

Last week we started a discussion on some of the colors of hydrogen, the efficiency and environmental impacts associated to each of them. Our focus this week is to continue that conversation now focusing on production economics.

Let’s look at some costs,

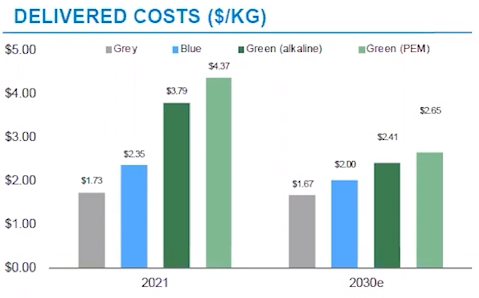

Recently, Tudor, Pickering, Holt & Co generated estimates that suggest that grey hydrogen is the cheapest with estimated costs of around $1.73/kg of hydrogen produced (that is to say, about $13/MMBtu). Then comes blue hydrogen with costs around $2.35/kg (some $18/MMBtu) and at last comes green with prices above $3.79/kg depending on the production method. In other words, $3.8/kg is approximately $28/ MMBtu . However, as prices of renewables sink, the price of green hydrogen will become sensibly smaller as well. That’s why we can see, on the graph to the right, that by 2030 blue hydrogens’ price will only decrease in a 17%, whereas green hydrogen will have decreased in more than a 50%, with prices of green hydrogen above $18/MMBtu, which even though it’s still a big number, shows a great improvement (estimations of decrease price of renewable energies in the following graph).

On the other hand, the decrease in the cost of natural gas, combined with further reduction costs in CCS would also help reduce the price of blue hydrogen.

Darcy perspective on costs and drivers

In order to better understand the key drivers of the different hydrogen production pathways, we built a simple model using public information about each process and then used that model to do some “what if” analysis.

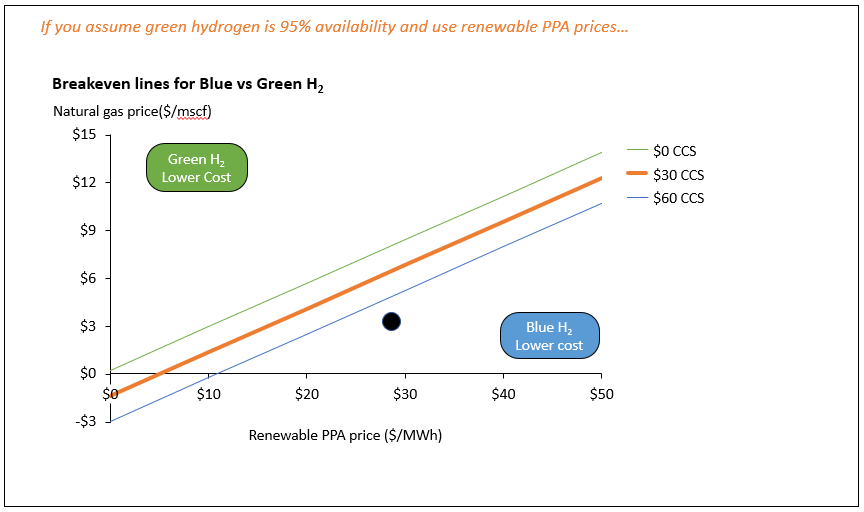

To generate estimated costs, we used EIA and LevelTen information for natural gas and power prices, as well as published information on grey hydrogen production costs and DOE targets for green hydrogen, along with a rough estimate for CCS costs ($30, varied below). [Note that the assumptions are likely more optimistic than those used in the Tudor Pickering and Holt analysis, since the grey hydrogen is for a well-developed process and the green hydrogen costs are a target vs. current performance]. For Green Hydrogen, we further wanted to see what the costs were for both a facility with a Power Purchase Agreement (PPA) for renewable electricity that allows it to run nearly continuously (95% availability), or if the Green Hydrogen plant uses curtailed renewables, meaning that the power is effectively free, but the unit only runs when power is curtailed. For curtailment, we assumed 15%, based on an NREL analysis of future curtailment without infrastructure, noting that current curtailment is normally below 10%.

So, what should we be looking at?

When deciding whether blue or green hydrogen there are 2 main drivers: environment and economics. An okey in both areas is needed to go forward, so the questions are:

- Where are you located?

- Do you have NG closely available?

- Do you have renewable energy available? How much?

- How is the relation: NG vs Renewable Electricity cost? What we think is more interesting, is seeing where costs may change and where the tradeoffs between the options switch to making green hydrogen more attractive in both PPA and Curtailed scenarios. For this analysis, we looked to see what natural gas price leads to parity with green hydrogen, first while varying PPA prices and second while varying availability due to curtailment:

In this first case (with the black dot roughly representing current US pricing), we see that with our $30/ton CCS cost, renewables would either need to be under $20/MWh or natural gas prices above about $6/mscf. While neither of these cases are true in the US today, in many geographies higher natural gas costs may tip the scales to make Green Hydrogen more attractive, and as renewable prices reduce this may be common over more geographies.

In the second case, even with a relatively large curtailment of 15%, blue hydrogen is much cheaper, and would require natural gas prices to be nearly $10/mscf.

So, some conclusions are…

Taking into account what we discussed last week in terms of GHG emissions, green hydrogen is leading the market providing virtually low to zero emissions. Taking into accounts our decarbonization factors this might be a key factor to boost this kind of hydrogen in the future. On the other hand, taking into account the efficiencies of production, the amount of renewable energy needed to produce 1 MWh of green hydrogen leads us to consider the fact that it might simply be too energy expensive, unless electrolyzer tech improves its efficiency in the future (given that this is a relatively new technology, hopes are that this will happen). Thus, when speaking of efficiency, gray hydrogen leads the way, followed by blue.

Then, from what we've seen this week, from the price of blue and green analysis, it can be seen that blue hydrogen costs are not only now, but also in the near-term future, expected to be well under the prices of green hydrogen, being the most cost-effective solution. From the green hydrogen options, currently, due to the relatively high capital cost of electrolyzers, it is more cost-effective to run green hydrogen with a PPA than to operate it at low availability with curtailed renewables. In many cases, the rise of the price of NG is what will tip the scales towards green hydrogen, varying from location to location. For green hydrogen to work in a purely curtailment state, it is likely that capital and operating costs of electrolysis need to be reduced substantially to allow a cost-effective solution when running at low availability. Since electrolysis is a relatively new technology, this sort of “quantum leap” is indeed possible.

All in all, the decision-point in any project is the economic viability (and an acceptable efficiency). This means that, given the current available technology, blue hydrogen seems to be the advisable choice. However, fundings and investment in technology R&D might change this landscape and tilt the scales towards green, we'll have to wait a bit to tell.

What are your thoughts on the topic? Are you currently producing/buying hydrogen? What type? Do you agree with our economics? We would love to hear your opinions on the topic!

Related Content

Hydrogen Offtake - Market Landscape

Energy Transition

Industrial Decarbonization

H2 & Low Carbon Fuels

Hydrogen

Wolftank Group - Refueling Stations Presentation

Energy Transition

Industrial Decarbonization

H2 & Low Carbon Fuels

Hydrogen

Executive Summary - Cold Tech, Hot Returns: Cryogenic CCUS

Energy Transition

Carbon