Register

Is Carbon Market becoming bigger than Crude Oil?

Insight

•

Updated June 23, 2021

"It's going to take a heroic effort; it will take not billions but trillions of dollars... And a lot of that will have to be private capital, so there's a really desperate need, and it must be soon for the right market signals and incentives to attract this private capital. And it is not just about carbon pricing or what clean standards are today, but what they are expected to be. What are they expected to be in 5/10 years from now? And how credible are those expectations" - Katie Sullivan

Mora Fernández Jurado

Darcy Partners

Energy Transition

Carbon

Last week saw a flurry of headlines and commentary around reports that market participants see the potential of how the carbon credit market could potentially become larger than the current crude oil commodities market. This aligns with the OECD’s (Organization for Economic Co-operation and Development), position that putting a price on carbon is essential to drive the technological and behavioral innovation necessary to limit climate change. Implying that market-based instruments, such as cap-and-trade emission trading schemes, are crucial to spurring action. The question in our minds has been – and we want to hear from you – Isn’t that headline a little misleading?

To help answer that question, we had Katie Sullivan, Managing Director at IETA (the International Emissions Trading Association) present at the Executive Roundtable to share her views on this topic and the potential implications for the energy space. During the Roundtable, we discussed the intersection between the commodity market and finance. Katie also spoke about what lies on the horizon and how it will impact the operators in the future.

Paris is a different world than Kyoto

In the wake of the 2016 Paris Agreement, more than 195 countries have put forward GHG reduction targets, called "Nationally Determined Contributions" (NDC). For instance, in September 2020, the EU published its new interim target of reducing emissions by at least 55% from 1990 levels by 2030. The goal of these pledges is an attempt to limit the global temperature increase to 2°C, and ultimately reduce it to 1.5°C by mid-century. The focus so far has been on net-zero GHG emissions and deploying carbon sinks. In addition to the governmental actions, we have seena rising number of organizations and companies setting net-zero emissions targets by 2050, at the very latest, to match government-submitted NDCs.

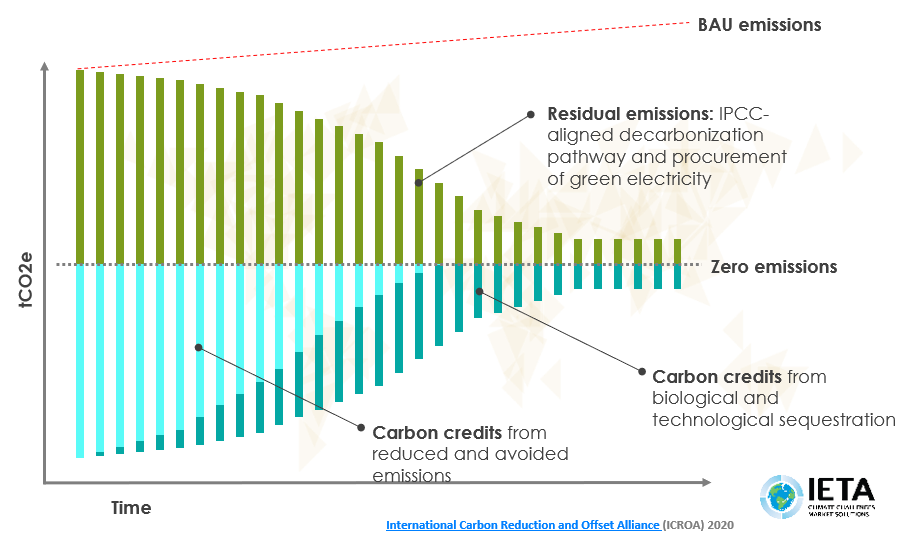

The conceptual chart above showcases how the path to net-zero could play out through 2050.

- In dark green, you can see all current and future residual emissions (aligning decarbonization pathway and procurement of green electricity). These are the emissions that have to be reduced, removed, and ultimately avoided.

- In light blue, you can see the impact of carbon credits from reduced and avoided emissions - which will play a critical role through the next decade or so.

- Finally, we have the dark blue, which gets bigger as we go into mid-century. These are carbon credits derived from biological and technological sequestration like soils, forestry, DAC (direct air capture), and CCUS (carbon capture, utilization, and sequestration) – efforts to actually remove GHG’s from the system.

To quote Katie during the Roundtable,

"The big takeaway is it all matters. It's going to take a heroic effort; it will take not billions but trillions of dollars… And a lot of that will have to be private capital, so there is a real desperate need, and it must be soon for the right market signals and incentives to attract this private capital. And it is not just about carbon pricing or clean standards are today, but what are they expected to be. What are they expected to be in 5/10 years from now? And how credible are those expectations".

Here's where Carbon Offsets come into play. According to the MIT Climate Portal, carbon offsets fund specific projects that either lower CO2 emissions or sequester CO2. Some common examples of projects include reforestation, building renewable energy, carbon-storing agricultural practices, and waste and landfill management. In the Darcy Connect platform you will find a number of companies in this space (non-exhaustive):

- Pachama harnesses AI and satellite technology to drive carbon capture and protect global forests. The company sells carbon credits and uses AI and satellites to understand how forests capture carbon and how effective that is.

- Wasatch Resource Recovery processes organic wastes to generate RNG and offset LFG emissions

So will the market for carbon really become larger than the global crude oil market?

Pricing carbon is one of the most effective and lowest-cost ways of inducing the reduction of CO2e emissions. For that, article 6 of the Paris Agreement states that countries can cooperate to reach their climate goals or enhance their ambition by establishing international trading markets. As always, these things are easier said than done, as standards and requirements vary from country to country and jurisdiction to jurisdiction within federal borders, in the case of Canada and the US.

Establishing a central market and pricing mechanism for carbon emissions would incentivize the development and deployment of carbon neutral or negative projects and technologies by internalizing the environmental and social costs of carbon to corporations and investors.

There are two main categories of carbon markets:

- Emissions Trading Systems (ETSs) - also known as a cap-and-trade mechanism, they set a mandatory limit or cap on GHG emissions on a predefined set of emission sources and participants can buy or sell credits to match their emissions levels for a set period.

Alternatively,

- A new voluntary scheme as defined in the Paris Agreement, article 6.2. States voluntary cooperation in the implementation of the countries’ NDCs allows for more ambitious mitigation actions. Voluntary schemes enable the use of Internationally Transferred Mitigation Outcomes (ITMOs) towards their NDCs voluntarily.

A good example of ETS systems is the one of the EU. The EU ETS is a cornerstone of the EU's policy to combat climate change and a key tool for reducing GHG emissions in a cost effectively manner. It is also the world's first carbon market and remains the largest. As we discussed in the Roundtable and cited in a recently Bloomberg article the cost of carbon has doubled in the last 12 months from 25 - 30 EUR/Ton in 2020 to ~50 EUR/ton today and forecast of €75+ EUR/ton by this summer.

So is that bigger than the global crude market?

The same Bloomberg article referenced above implied that to reach net zero targets the market for carbon would be larger than the global crude market. Let’s look at the math – each barrel of crude oil when fully processed and consumed produces ~0.6 tons of CO2e – using the current pricing of €50 this equates to ~$35/bbl in carbon pricing – which is below the current spot price of ~$70/bbl. What is missing from the attention-grabbing headlines is that the cost of carbon required to meet the net-zero emissions would require substantially higher pricing than where it is today – using $70/bbl it would imply carbon pricing of $117/Mt or above for the carbon market to be larger than the market for crude oil. This would assume full global coverage of a cap-and-trade system (since crude is consumed) and ignores the $-value of the global refined products market.

This is certainly a lot of money moving in these markets and there is confidence that the market will be there for a longer time, allowing for business to adapt and plan. The EU is expected to release an update on the European Green Deal on July 14th. We, along with everyone else will be paying attention to this release, in the hopes that that will see a proposal for a broader and more comprehensive market for emissions trading.

What is happening elsewhere?

- China launched its national carbon trading system this year. They previously had trading systems at the provincial level and have consolidated them to a national level. It starts with covering 220 power plants that emit around 2 billion tons a year. The first trades are supposed to occur this week. So, all eyes are also in China and how this will work out. The objective is to cover cement, steel, and aluminum over the coming years into the black carbon market.

- In Latin America: Colombia, Chile & Mexico are working to cooperate and link their carbon markets

- In the US a lot of attention has been drawn to enabling the voluntary carbon market, especially the smart agricultural forestry, using the carbon market to bring money to these opportunities. As previously mentioned, there are also many state actions, such as the Californian carbon trading system.

With this we come back to our initial question, and really what we want to hear from you – Is or isn’t that headline "how the carbon credit market could potentially become larger than the current crude oil commodities market" a little misleading?

REFERENCES: