Register

It Feels Like This Time Might Be Different For OFS

Insight

•

Updated October 28, 2021

Historically, the OFS sector has relied on M&A and internal development to bring new technology to market, but it's starting to seem like that might change.

David Wishnow

Darcy Partners

Oil & Gas

Historically, the OFS approach to technology and innovation has been to either develop it in house or acquiring complementary/competitive product offerings. This often went hand-in-hand with higher capex budgets and capacity additions. However, it seems like there is a new appetite for partnering with many of the innovators we have showcased historically.

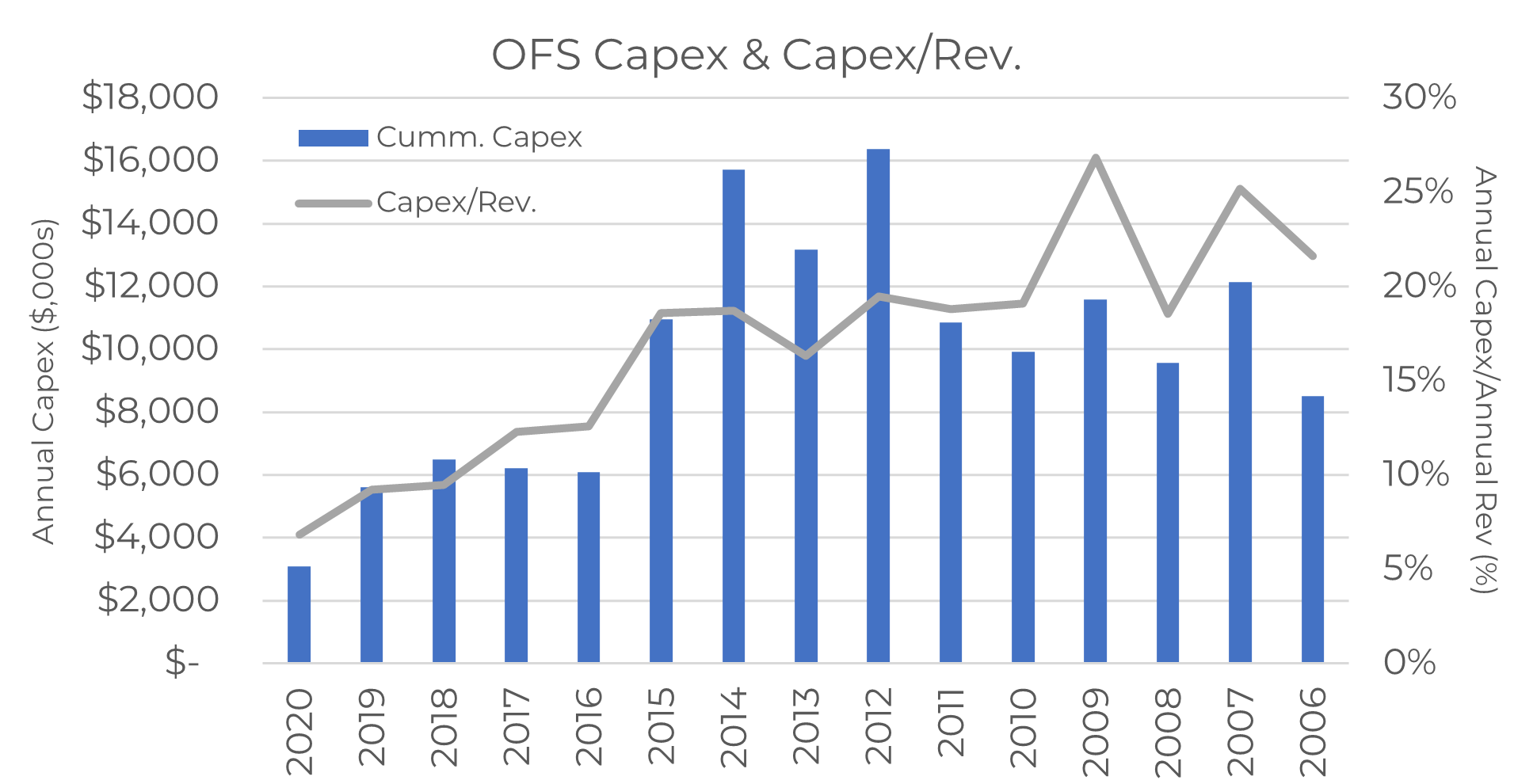

Similar to the oft-discussed “living within cashflows” mantra for operators, the OFS sector is subject to investor mandates to minimize spending and instead focus on capital efficiency. This has resulted in OFS capex as a %age of revenue declining to ~6% from the historical range in the 20-25% level. This low level of spending necessarily results in less innovation being driven by the incumbent service providers.

Note: representative sample of Halliburton, Helmrich & Payne, Nabors, NOV, Patterson-UTI, Transocean, Schlumberger & Weatherford

In the past few weeks we have seen the announcement of strategic partnerships and investments in venture rounds from incumbent service providers which we would have historically expected to focus on either outright acquisitions or developing inhouse solutions.

For Example (not exhaustive):

Oct. 2021 - Baker Hughes invested in Augury’s $180MM Series E funding round.

Oct. 2021 – Patterson-UTI and Corva announce a strategic partnership to provide advanced analytics solutions.

Aug. 2021 – NexTier Oilfield Solutions partners with Silixa to launch Intellistim frac optimization system.

Aug. 2021 – Schlumberger invested in DeepIQ’s seed round.

Aug. 2021 – Nabors invested in Quaise’s venture round.

Jul. 2021 – NexTier Oilfield Solutions partners with Corva to provide an integrated remote completions solution.

Jul. 2021 – Schlumberger was the lead investor in SeekOps’ series B round.

Apr. 2021 – Helmrich & Payne invested in Fervo’s Series B round.

While it may be too early to call these data points confirmation that the OFS sector is wholesale looking to a more collaborative future with emerging technology providers – and there are still plenty of examples of incumbent services providers acquiring innovators – see ChampionX and Scientific Aviation. It is an encouraging sign that perhaps the large public service providers are prepared to help foster innovation.

Related Content