Register

Surfing The Next EOR Wave

Insight

•

Updated November 3, 2021

This is a forward looking article, trying to put some EOR challenges over the table for further discussions and presentations

Andres Lopez Gibson

Darcy Partners

Oil & Gas

Completions

Production

Subsurface

There is certain modulation to the overall interest in Enhanced Oil Recovery (EOR) projects, probably triggered by the periodic high tides and subsequent low tides of oil prices. Looking at the following graph, we realize why 2014 was the end of some of that interest, and we would speculate that a big EOR wave is coming!

Would you like to surf it?

Image 1: Historical Oil Prices

Image 1: Historical Oil Prices

This reiterative pattern of resurgence and subsequent halt, or even abandonment, of EOR project interest is associated with the type of project and the triple constraint trilemma as stated by the Project Management Institute (PMI): "The quality of a project is determined by the TIME, the SCOPE and the COST of the tasks required to do it". In this article, we are going to focus on some of the common project management challenges to develop successful EOR processes. If you are more interested in a specific technical aspect of EOR, please let me know in a comment and we can focus some more time on a specific topic in the future, or you can wait and see what we are preparing for 2022!

TIME:

The survey results from last month’s forum, Multi Scale Reactive Interactions, show clearly that bringing new technology to the field takes a lot of time: 87% of the respondents mentioned that it takes them at least one or more years to scale a technology such as EOR from the lab to the field.

Image 2: Time to scale up technologies to field (Multi Scale Reactive Interactions: OPERATOR SURVEY RESPONSES)

Image 2: Time to scale up technologies to field (Multi Scale Reactive Interactions: OPERATOR SURVEY RESPONSES)

This has to do with the complexity of the technical problem, the multi-dimensional uncertainties and risks associated with it, and the need to validate each step of the process until implementation, which brings us to the VCDE workflow (Visualization, Conceptualization, Definition, Execution, Operation).

SCOPE:

The objective of an EOR Roadmap is to reduce reservoir and field uncertainties as well as economic risk, and is an example of what is required to technically transition from the lab to the field. In the following image I show a typical VCDE or FEL Roadmap that is also applicable to other technologies such as CCS or other subsurface de-risking projects.

Image 3: From the LAB to the FIELD Roadmap

Image 3: From the LAB to the FIELD Roadmap

The x-axis represents the efforts and investment into the project, while the Y axis represents uncertainty and risks. Considering that each step is one order of magnitude greater in time and effort than the last, the entire Lab-to-Field process has a clear objective to reduce the risks and uncertainties for the following steps. This can be done by iterating between the initial phases, with an effort to cycle less on the later phases of the project. This is known as a "rolling wave" project structure, where each stage conditions the following ones. This requires a work breakdown structure (WBS) phase by phase, where previous phases can be revisited if the desired outcomes or certain conditions are not met at each gate.

If we consider a sequential approach, as suggested with the upper chevron line, after the Kick Off (KO), where the EOR methods and field screening is done, the selected field is sampled, and the lab work provides results with which modeling and simulating can begin. With this approach, the project could progress one or more years, and by the time field tests and pilot implementation can take place, three or more years could have already passed since the KO.

A way to crunch this roadmap (as shown in the lower chevron line) is by parallelizing phases, where an iterative process between the Digital, Lab, and Field spaces can help with the uncertainty quantification, scenario evaluation, and optimization of the experimental design for the lab and field tests, particularly by starting very early with modeling and simulation efforts. To illustrate this with some recent technology featured in Darcy, we present this framework:

Image 4: Pyramid including Digital solutions, Lab technology, Field Implementation (individual Innovators can be accessed through the link)

In the lower left we find digital Innovators for simulation and digital rock that can help achieve a faster field development by accelerating the iteration cycles and decision speed during the ideation and conceptualization phases. SaaS and cloud solutions facilitate the access to more innovative tools (such as the recently shown aiRock platform in the Forum with AquaNRG) for modeling critical fluid-solid interactions in the subsurface in rocks, fractures, and man-made materials, by coupling flow physics with (bio)(geo)chemistry and multiscale chemical-physical computational dynamics solvers as well as high performance cloud computing.

To characterize and complete the proof of concept to those ideas and models in the Lab, we have core analysis and specialty labs like Green Imaging Technologies Inc. (GIT), that offer NMR/MRI technology for rock core analysis for fluid typing, fluid quantification, saturation profiles, and spatially resolved porosity and wettability measurements at ambient and reservoir conditions. Interface Fluidics offers rock/fluids analysis with their reservoir-on-a-chip method, providing a scalable solution for testing formation/fluid compatibility, polymers / surfactants performance evaluations and in situ rheology measurements, with dozens of tests that can be performed simultaneously with differing fluid parameters and chemical loadings to assist in fluid analysis.

Finally, in the top side of the pyramid, we include monitoring and evaluation technologies that will help on the proof of implementation of the process, like fiber optics, seismic, electro-magnetics, or specialty tracers like Chemical Tracers Inc. (CTI). This company specializes in in-situ reservoir characterization with their one-spot EOR pilot, the SWCT (single-well chemical tracer) method, allowing clients to evaluate EOR processes from a single well.

However, there is still plenty of room to improve the way we do field tests and appraisal to scale up from the LAB to the FIELD, which would help reduce the risk and time of EOR projects as shown in the following survey results of :

Image 5: Room for Improvement to reduce risk and time

Image 5: Room for Improvement to reduce risk and time

De-risking shouldn't stop with a viable technical solution to improve recovery: a full TECOPS analysis is needed to understand what the real multi-dimensional impact of the project in a field is, and to help optimize the best way to implement certain processes (listed below).

- Technical: Subsurface, Surface, Technology, Operations

- Economical: Costs, phases, Finance, KPIs, exit strategy

- Commercial: Fiscal Regime, Contracts, Market, Liability

- Organizational: Structure, Resources, Competencies, KM, IT

- Political: Government, Stakeholders, Security, Community

- Sustainability: HSE, Environment, Employment, In Country Development (ICD)

To help with this, the EOR technology companies that develop the products and equipment for EOR processes, as well as consultants that have the know-how, can greatly facilitate the de-risking process. This brings us to the next main point: money.

COST:

Considering the original time constraint associated with oil price cycles, and with the spirit of accelerating the TECOPS de-risking early-on to make more robust decisions, bringing on field tests such as injectivity and push-pull tests like the SWCT could improve our overall understanding of how the EOR technology process will actually affect our field. The problem is, it typically takes a lot of money upfront to do all of this, and without a commercial project that is already generating dividends, this gets tricky.

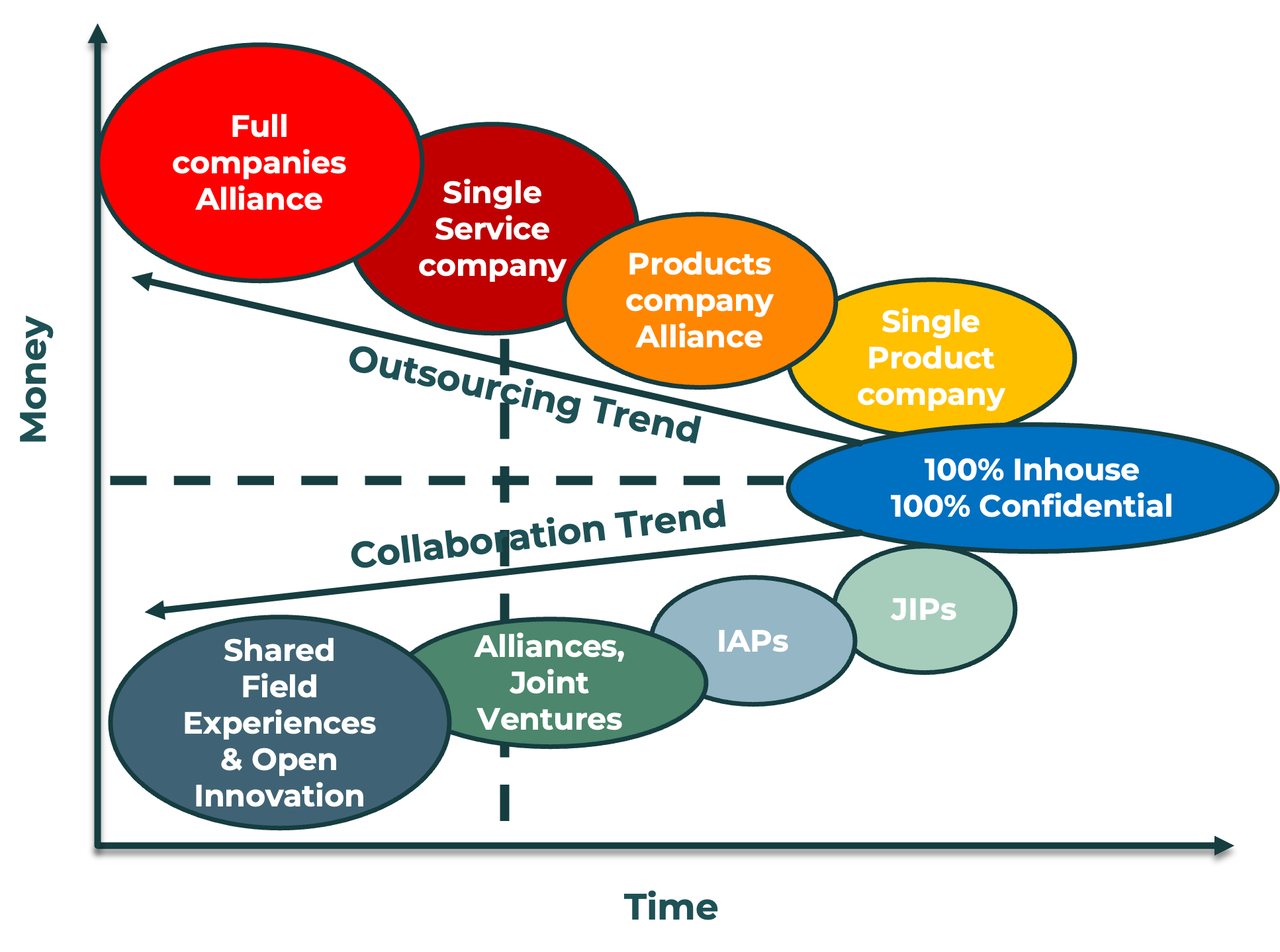

Another way E&Ps can reduce uncertainty is by outsourcing the above mentioned process to products and service providers. As a conceptual example of the time and money cost this could imply, on the following image, the upper trend represents increments in the outsourcing, starting from 100% inhouse, followed by only outsourcing the product development to a single products company, then expanding the contract to an alliance of products providers, followed by a single service company, and ending with a full service and products company alliance.

Image 6: Time & money efforts - Outsourcing vs Collaboration trends

Image 6: Time & money efforts - Outsourcing vs Collaboration trends

Focusing on how operators could reduce costs without compromising the project quality, another approach to reduce uncertainties is to openly share lessons learned between peers and by association either to other E&Ps, as with vendors, as a conceptual example of the the lower trend representing incremental collaboration, starting from 100% confidential, followed by participation in Joint Industry Projects (JIPs) and Industrial Affiliate Programs (IAPs) that normally are academic in nature and take more time, then to the Alliances & Joint Ventures, followed by shared field experiences and open innovation.

Selecting research groups, companies, organizations, and experts that have passed all of the above stages in a collaborative manner is one of Darcy's focuses we are willing to help change uncertainty to knowledge, cost to investment, and risk to success.

CONCLUSION:

There are several opportunities that EOR processes bring to the table. For example, the life extension of mature fields, or even the reactivation of uneconomical assets, can be achieved with the correct technology and the reuse of wells, but this comes with added risks associated to uncertainties, upfront costs and and longer payback time than other solutions. This means that they require strategic planning to counteract the oil price tides: De-risk, negotiate products, equipment, and services when oil price is low, and produce when oil prices rise. To address the scope of an EOR project, an E&P requires robust project management with a "rolling wave" type of planning, including TECOPS risk and scenario management from the start.

Innovation in EOR comes in waves, which is why having a technology surveillance platform like Darcy is an asset for E&Ps that are targeting to surf in the crest of the wave! If you have EOR experiences you would like to share or some challenges you would like us to help you address please let me know in the comments below or contact us directly to further discuss on specific EOR / IOR solutions.

References:

- COP26: oil price soars even as the world turns against fossil fuel

- IEA, Number of EOR projects in operation globally, 1971-2017, IEA, Paris

- PMI PMBOK 6th Edition Guide

- Energy Technology RD&D Budgets 2020 Statistics report IEA — October 2020

- EOR: una estrategia sustentable, Sebastian Kaminszczik and Andres Lopez Gibson, dec 2016, for IAPG Cover

- Building an Enhanced Oil Recovery Culture to Maximise Asset Values, Kristian Mogensen ADNOC et al., 2015 for SPE EOR Conference

- EOR Managment, William Schulte SOGIC, april 2014, for Increased Oil Recovery at Lower Oil Prices, SPE JPT, Feb 1989, 164/170

- R&D Solutions for OIL & GAS EXPLORATION & PRODUCTION Enhanced Oil Recovery—Do You Have the Right EOR Strategy?

- Has the Time Come for EOR? Oilfield Review Winter 2010/11 22, no.4