Register

The Promising Future of Offshore Wind Power

Insight

•

Updated June 17, 2021

Offshore wind is expected to have an important role towards grid decarbonization. Find out how this market is developing and what challenges remain unsolved.

Juan Corrado

Darcy Partners

Energy Transition

Power & Utilities

Renewables & Energy Storage

A few weeks ago, the Biden Administration laid out an ambitious goal of cutting US greenhouse gas emissions by at least 50% by 2050, compared to 2005 levels.

Achieving this goal will require an enormous effort and a transformation from all markets but offshore wind is a central part of the Biden Administration's clean energy agenda. To start developing this unknown terrain for the US and catch up with the European and Chinese market, President Biden has already called for 30 gigawatts by 2030.

Figure 1. Emissions and expected warming based on pledges and current policies. Source: Climate Action Tracker, December 2020.

Figure 1. Emissions and expected warming based on pledges and current policies. Source: Climate Action Tracker, December 2020.

Rystad Energy laid out a model that considers the most achievable roadmap to reaching President Biden's goals. It calls for spending a staggering $2.5 trillion US dollars on renewable energy projects in this decade alone and sharp cuts to fossil fuels.

Under this scenario, under normal weather conditions, wind and solar will generate 63% of the power in the US by 2030 – with storage solutions to handle their intermittency.

Figure 2. Total primary energy before losses in the US, modelling to achieve Biden targets. Source: Rystad Energy WorldCube Pilot.

Figure 2. Total primary energy before losses in the US, modelling to achieve Biden targets. Source: Rystad Energy WorldCube Pilot.

While Solar PV resources are abundant along the coast and southern belt and onshore wind resources are bountiful in the mid-continent, offshore wind is especially important to decarbonize the Northeast coastal states. Nearly 80% of the USA’s electricity demand occurs in the coastal and Great Lakes states. Dan Shreve, the Wood Mackenzie executive, noted that those states often have dense populations and yet lack the space or climate needed for large-scale solar and onshore wind power generation – but do have exceptional offshore wind resources.

Figure 3. US offshore wind resource at 90m above the surface. Source: NREL - Assessment of Offshore Wind Energy Resources for the United States

Figure 3. US offshore wind resource at 90m above the surface. Source: NREL - Assessment of Offshore Wind Energy Resources for the United States

In May, after thousands of public comments and hundreds of hours of public hearings, the Department of the Interior approving a project that languished for years: the $2 billion Vineyard Wind project. Located 15 miles off the southern coast of Martha's Vineyard, Vineyard Wind will be the nation's first commercial scale offshore wind farm and is promising 800 MW of renewable capacity from 84 offshore turbines, to be delivered to Massachusetts by the close of 2023.

Vineyard Wind will be powered by the Haliade-X, the world's largest and most powerful offshore wind turbine. The 13MW turbine, manufactured by General Electric, stands 853 feet (260m) tall - nearly as high as the Eiffel Tower - and its blades are 350 feet (107m) long.

"Just one rotation of the turbine will power an entire Massachusetts house for a day. It's staggering." "There has been an extraordinary acceleration of the technology", said Bill White, vice president of offshore wind at Avangrid Renewables, which co-owns the Vineyard Wind venture along with Copenhagen Infrastructure Partners.

Eventhough this is an important milestone in the US Energy Transition and development of offshore wind, hopefully will keep the wheel turning for more projects to come. While Vineyard Wind is a large project, the 800 MW of power it will generate is a drop in the bucket of what's needed (30GW).

Keeping the goals President Biden is setting will definitely be hard to keep but an accelerated growth of wind and renewable energy is required to “bend the curve” and put us on a trajectory which can limit global warming to “well below” 2°C, as set out in the Paris Agreement. Current policies are propelling us towards a 2.9°C pathway by 2100. If all pledges and NDCs as of December 2020 were implemented, we might reach 2.1°C and will miss a net zero by 2050 target.

Global Market

2020 saw global new wind power installations of 93 GW, a 53% growth compared to 2019, bringing total installed capacity to 743 GW, a growth of 14% compared to last year.

Figure 4. Historic development of total wind installations (GW). Source: Global Wind Energy Council.

Figure 4. Historic development of total wind installations (GW). Source: Global Wind Energy Council.

New installations in the onshore wind market reached 86.9 GW, while the offshore wind market reached 6.1 GW, making 2020 the highest and the second highest year in history for new wind installations for both onshore and offshore.

Figure 5. Historic development of total wind installations (GW). Source: Global Wind Energy Council.

Figure 5. Historic development of total wind installations (GW). Source: Global Wind Energy Council.

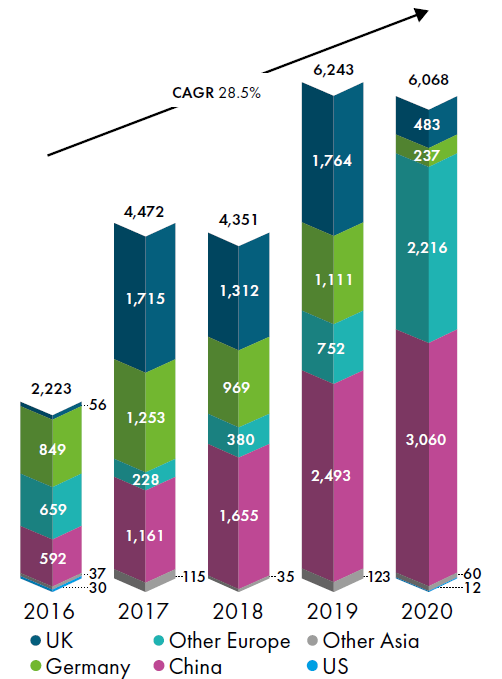

While the UK has the largest offshore wind power capacity (10,4GW), China is rapidly expanding, leading in new installed capacity for the third year in a row with over 3 GW of new offshore wind capacity in 2020.

Figure 6. New offshore installation in 2020 (MW) and Compound Annual Growth Rate (CAGR). Source: Global Wind Energy Council.

Figure 6. New offshore installation in 2020 (MW) and Compound Annual Growth Rate (CAGR). Source: Global Wind Energy Council.

Offshore wind is expected to grow from 6GW in 2020 to nearly 80GW in 2024, bringing its market share in global new installations from 10% in 2020 to 20% by 2024.

Costs

The cost of offshore has historically been higher than that of onshore, but new-build offshore wind has seen the fastest cost fall of any renewable energy source, according to BNEF. Costs decreased to $78/MWh in the second-half 2019 – down 32% on the same stage in 2018 and 12% from the first half of the year.

In the first half of 2020 alone, while overall investment in power generation slumped, offshore wind financing quadrupled compared to the same period in 2019, reaching US$35 billion. And CAPEX committed to offshore wind overtook investment in offshore oil and gas for the first time.

Part of that is the evolution of the turbines themselves, which are much more powerful than a decade ago. Cost reduction from larger turbines, innovations in installation and O&M and reduced investor risk will further drive deployment. Out to 2030, IRENA expects average LCOE of onshore wind to continue declining by 25% from 2018 levels, while offshore wind LCOE will shrink 55% from 2018.

Challenges

While the offshore wind industry has grown dramatically over the last several decades, it is also a fact that the isolation of offshore wind farms makes construction and O&M challenging and more time is needed to fully comprehend the impact of these installations on marine life.

Still, the world needs to be installing an average of 180 GW of new wind energy every year to limit global warming to well below 2°C above pre-industrial levels, and will need to install up to 280 GW annually from 2030 onwards to maintain a pathway compliant with meeting net zero by 2050.

Initiatives like the UN-linked Ocean Panel and Ocean Renewable Energy Action Coalition (OREAC) have highlighted offshore wind as a vital technology which will provide 10% of the needed carbon mitigation by 2050 for a 1.5°C pathway.

Thankfully, there has been innovative solutions for the construction of offshore wind farms and their O&M, which are driving even further their deployment.

Would you be interested in Darcy evaluating this market and find innovative solutions for construction and/or O&M solutions for offshore wind farms? Let us know your opinion below!

References and further reading

- Joyce Lee, Feng Zhao. (2021). Global Wind Report 2021. Global Wind Energy Council. Link.

- Egan, Matt. (May 16, 2021). The stakes couldn't be higher for America's first major offshore wind farm. CNN Business. Link.

- Rystad Energy. (May 14, 2021). Making Biden’s climate plan work: Rystad Energy models the most achievable recipe. Rystad Energy. Link.

- Lee, Andrew. (October 22, 2019). Offshore wind power price plunges by a third in a year: BNEF. Recharge. Link.

Blog post image courtesy of Nicholas Doherty. Published on January 24, 2019. Rampion Offshore Wind Farm, United Kingdom.

Related Content

Fischer-Tropsch Production - Innovator Comparison

Energy Transition

Industrial Decarbonization

H2 & Low Carbon Fuels

Low Carbon Fuels

Nexxis Company Presentation 2025

Oil & Gas

Power & Utilities

Asset Management & Digitization

Subsurface

Sensorfield - Utility Applications

Oil & Gas

Power & Utilities

Asset Management & Digitization

Production

Sensorfield - Underground Transformer Monitoring - Case Study

Oil & Gas

Power & Utilities

Asset Management & Digitization

Production